There is nothing rotten in the state of Denmark.

Published 1. oct. 2024

There are two primary instances where it’s a good time to trade in selected luxury watches…

When there are short-term high fluctuations in the financial markets, and more stably and long-term, when the economy is generally doing well. However, different categories and models of watches perform differently, so selection is key.

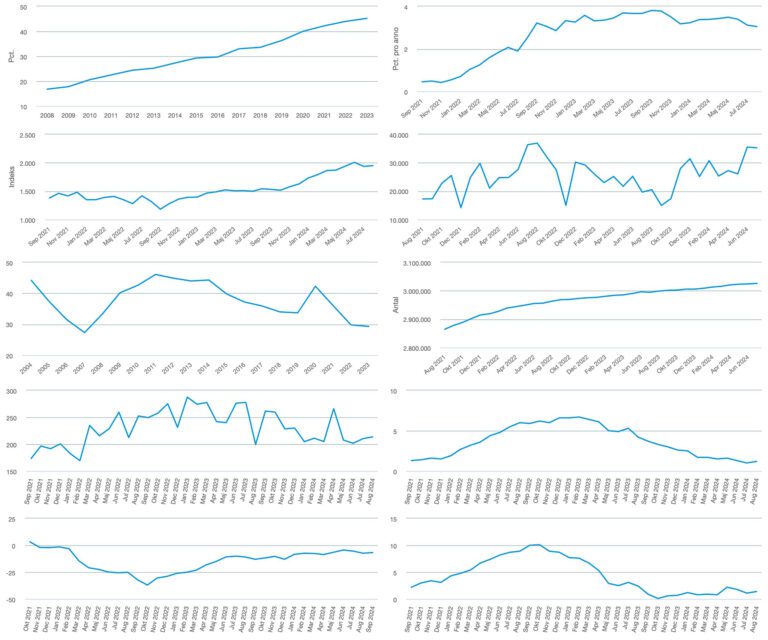

For a long time, there has been unclear data regarding inflation, interest rates, and conflicting signals to and from the Central banks, which currently have the greatest influence on the global economy. There are still questions in the air—not least with the recent 0.5% reduction in the FED’s interest rate and the escalation of tensions in the Middle East. However, if we look at our own little Danish pond, where 95% of our sales take place, things are actually going very well. Below are exclusively updated figures from Statistics Denmark (Danmarks statistik), which paint a picture that we are where we need to be:

Consumer confidence has been on a steady upward trend for exactly 2 years. It has gone from -37 to the current -6.8.

Inflation, which has been the root cause of interest rate increases, is under control and has gone from 10% to 1% over the last 2 years. The target is 2%, and over the last year, we’ve been between 2.2% and 0.1%. Currently, inflation is at 1.4%, and core inflation is at 1.2%.

Retail sales, the confidence indicator for businesses, and the industrial production index have all been in an uninterrupted positive trend over the past 2 years.

The number of bankruptcies is at its lowest in over 2 years, while the number of employed people is setting new records.

Public debt has gone from 46.1% in 2011, 42.3% in 2020, to now 29.3% (as a percentage of GDP). At the same time, the current account surplus is at record highs of DKK 35.3 billion.

The price development for both apartments in Copenhagen and single-family homes has gone from -7.3% in Q1 2023 to the current 2.7% and 5.2% in the previous quarter.

Even environmental models are looking good. Greenhouse gas emissions have gone from 80.9 million tons in 2006 to 46.3 million tons, and the share of renewable energy has increased from 16.8% in 2008 to 45.2%.

Read the numbers yourself and more from Statistics Denmark here (in english)

We are still looking out into the wider world and keeping an eye on the global economy. As we have previously written about, there are still overpriced stocks and sector rotation, but luxury watches are really stirring now. The correction and stabilization have been achieved. At the index level, it’s still stable, but the individual selected luxury watches we trade are moving significantly. This is something we notice in rising sales, market movements, traffic on forums, and word-of-mouth among watch enthusiasts.

Have a chat with us, and we can guide you to the right choice, whether you’re looking for something for your wrist or to build an investment portfolio.

Book a meeting in the form below when it suits you.