ROLEX AND INVESTING

The history of Rolex stretches all the way back to the early 20th century and has undergone a lot of major changes along the way, introducing the world to revolutionary innovations and making a significant impact on horology, fashion, and lifestyle.

The famous watch brand is a recognized brand worldwide. Rolex is not only known as an aesthetically beautiful piece of wearable art for the arm or for its stunning works. The world-renowned watch brand has often proven to be a great investment.

INVEST IN WATCHES PROFESSIONALLY

The renowned brand has managed to maintain its popularity around the world, and there is no sign of this changing anytime soon. It turns out that more people are willing to pay more each year to get their hands on a Rolex watch.

This does not mean that Rolex watches necessarily increase in value every year. However, there is no doubt that Rolex watches are holding their value from the moment they leave the retailer until they end up on the second-hand market. As with other investments in physical assets, there are some Rolex models that manage to perform better when it comes to extreme increases in value over time, and some Rolex references that are more interesting to invest in than others. This is why the portfolio advisors at UrHandleren Invest sit down every day and carefully examine the market for trends and indications that affect the investment potential of watches.

ADVICE ON WATCHES AS INVESTMENTS

Just like any other investment, it is a clever idea not to invest in Rolex watches without knowing what you are investing in. Of course, there are some general trends and tendencies that our portfolio advisors specialize in covering. So if you want to invest professionally in Rolex watches without having to spend a lot of time researching and worrying about the right investment decisions, we are available with our expertise and insight into an exciting and complex market.

ROLEX’S VALUES

Rolex has managed to create a strong brand that stays true to its values even though the brand’s popularity has soared in recent years. This is one of the many reasons why Rolex has maintained its prestigious reputation in the world of horology.

Rolex does not compromise on its position and values, which is one of the reasons why we see a discrepancy between supply and demand. As a foundation, Rolex is not obliged to disclose turnover, assets, or output. It is estimated that Rolex produces around one million watches worldwide annually.

POPULAR ROLEX WATCHES

How can an investment in Rolex watches be a better investment than stocks, gold, and other physical assets?

We are accustomed to seeing that investments with low volatility can only provide low returns.

Therefore, it has been interesting to follow Rolex, which is one of the watch brands that has shown the opposite of minimal risk and high return over the past decade. Here we see how the Cosmograph Daytona, Submariner, Day-Date and Datejust models have exploded in the second-hand market.

Of course, other watch companies share the same prerequisite, Rolex is just among those that have done exceptionally well.

THE CONDITION OF A ROLEX WATCH

If you are buying a Rolex watch for investment purposes, it is important that you keep your watch in good condition.

While Rolex produces watches in durable materials such as Oystersteel and other precious metals that are designed to last forever, the condition of the watch is a crucial factor for your long-term investment. In general, wear and tear are assumed to be value-degrading for luxury watches, but again, there are other factors at play when talking about a worthwhile investment watch.

Wear and tear are not the decisive factor for the value of a watch. The model and reference of the watch, when a particular reference was produced, and discontinued models are also important aspects when evaluating a promising investment watch. The same applies to the countless combinations on a Rolex watch, including watch face combinations, chain combinations, and material combinations, which are also a contributing factors in sound investment watches.

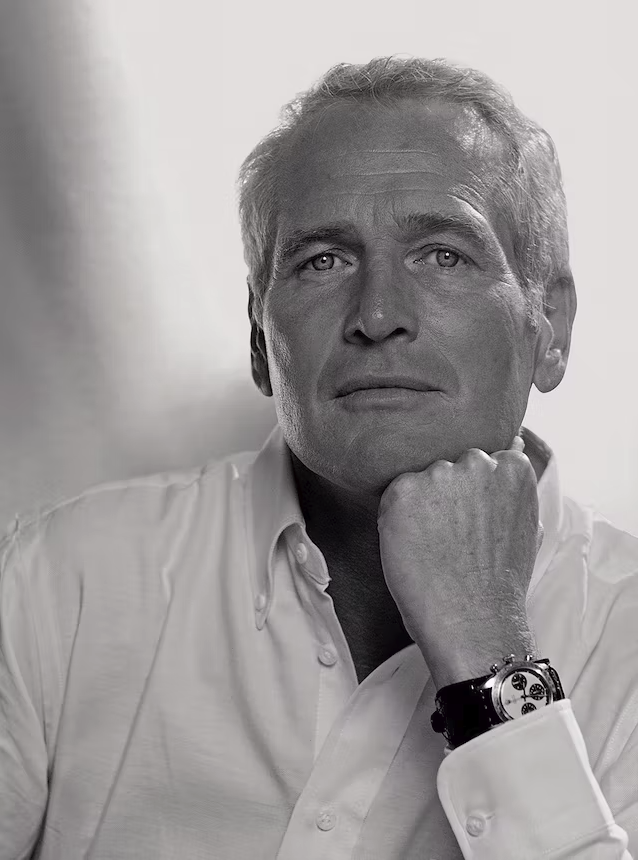

THE MOST EXPENSIVE ROLEX IN THE WORLD

In October 2017, Paul Newman’s personal Rolex Cosmograph Daytona, ref. 6239, sold in New York for a staggering 17.8 million dollars. Making it the most expensive watch ever sold. In May of the same year, the previous record for the most expensive Rolex watch had been broken when Vietnamese Emperor Bao Dai’s Rolex was sold for 5 million dollars.

Why is Newman’s Daytona so desirable? This stems from Newman’s iconic status as a style icon, actor, and passionate racing driver, as well as his historic connection with Rolex.

Of course, provenance also plays a vital role in the popularity of the watch. It was actress Joanne Woodward, married to Paul Newman, who gave him the watch back in 1969.

Newman was very fond of the watch, as it is a watch, he wore every day for fifteen years. On the back of the watch, Joanne Woodward had the text engraved: ”Drive carefully. Me” referring to Newman’s affinity for speed both on and off the racetrack.

In other words, Paul Newman’s personal Rolex Daytona possessed all the aspects that make a watch particularly desirable. The right model, with the right history and pedigree, and a unique personal story.

Credit: hoodinke.com

Read more

Read more