Positive news from Switzerland

In a year where we have experienced the biggest war on European soil since World War 2 and the most populous country on earth; China, still subject to massive Covid19 restrictions, there are positive news from the Fédération de l’industrie horologère Suisse – also known as FH.

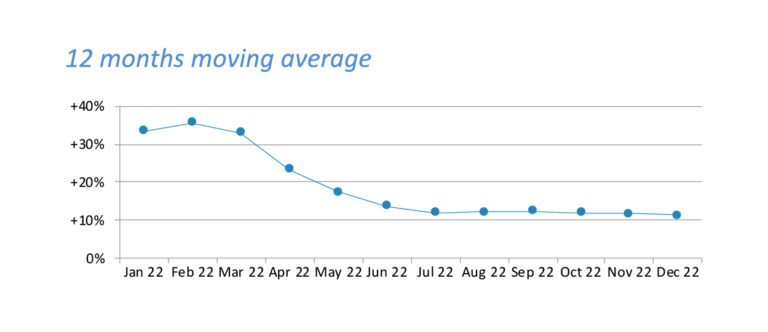

Never has the Swiss watch industry been in a better state, never has the export of watches been. In 2022, exports increased by as much as 11.4% compared to the previous year and we are now only one seconds away from hitting a total value of a massive 25 billion Swiss Franc.

Healthy growth

Where we at the end of 2021 and the beginning of 2022 experienced an almost explosive growth in exports month by month compared to the previous year, FH reports on the second half of 2023 with a much healthier and more stable growth – a growth that still hits + 10% month by month. We have switched from a jet fighter with the afterburners activated to a jumbo jet that cruises safely away. It is far healthier for customers, collectors, investors and dealers, indeed the industry as a whole, that we are no longer in a manic market where no one knows what tomorrow brings.

Discerning buyers

If you dive deeper into the figures from FH, it also stands out that there is a clear pattern in exports. Where in the past it was a growth in the volume of watches sold that drove exports up, today it is an increase in the value of the watches that drives the work, so to speak. Sales are still in the region of 15-16 million watches annually, but the average price of the watches sold has increased significantly. The export of steel watches fell, the export of watches made of “precious metals” increased. And this despite the fact that the Swatch Group has sold around 1 million MoonSwatches in 2022.

Watch UrHandler’s video about MoonSwatch here (in danish): https://youtu.be/OFsX3pKfK54.

For investors at UrHandleren Invest, it is positive that the de demand for the more expensive watches is increasing. This speaks directly to our predictions that we are dealing with a market with unimaginable potential. A market that is far from saturated. As an investor at UrHandleren Invest, you not only achieve a return when the watches increase in value over time, but also when we resell watches from your watch portfolio to an end user, and the greater demand we experience on both the Danish and European markets – which by the way grew by almost 15% in 2022 – the more watches we can sell and the bigger returns you can expect.

When China wakes up to virtue again, it will have the additional effect that the part of watch sales that in the past two years during China’s severe Covid19 lockdown has instead been sold in Europe will once again find its way to the great country in the east. This will in turn increase the waiting lists in Europe for ADs and boost the secondary market – to the benefit of the investors at UrHandleren Invest.

Read more

Read more